Some Ideas on Tax Amnesty You Should Know

Wiki Article

The Basic Principles Of Tax Amnesty 2021

Table of ContentsHow Tax can Save You Time, Stress, and Money.The smart Trick of Taxonomy That Nobody is DiscussingThe Basic Principles Of Tax Amnesty 2021 The Ultimate Guide To TaxonomySome Known Details About Tax Avoidance Meaning Some Known Questions About Taxonomy.7 Easy Facts About Tax Explained

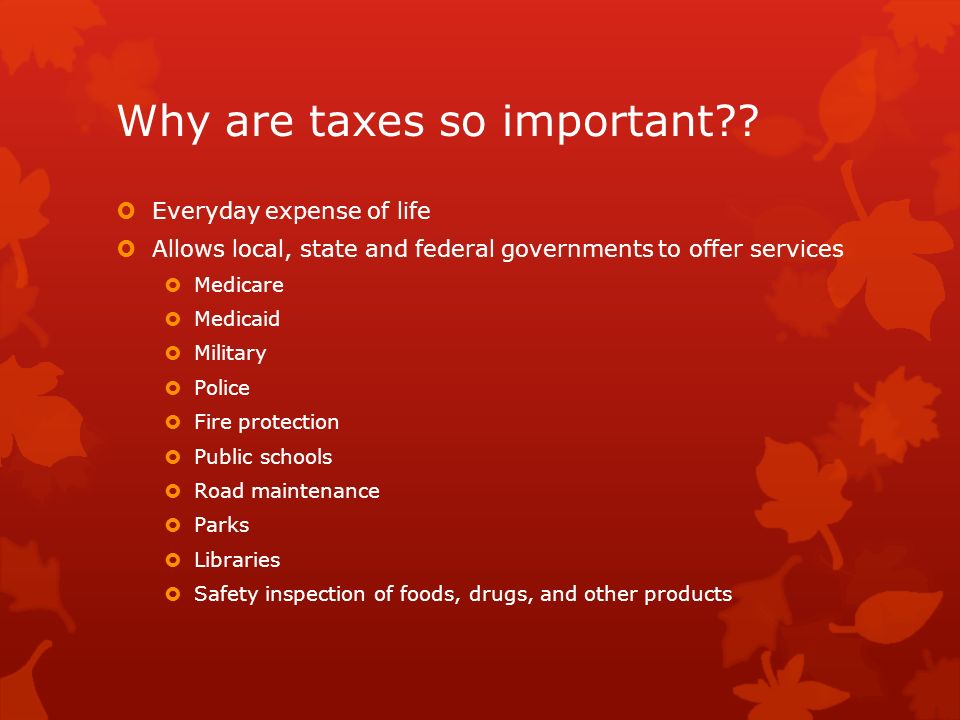

More Analysis, For more on income tax obligation, see this Northwestern Legislation Institution post and this College of Chicago Law Review post.To satisfy their expenditures, government requirement revenue, called "revenue," which it raises with tax obligations. In our nation, federal governments impose a number of different types of tax obligations on people and businesses.

Some Known Details About Tax Avoidance Meaning

Some services are extra effectively provided when government companies plan as well as provide them. Everyone benefits from these services, and also the most useful way to pay for them is via taxes, rather of a system of service fees.These controls frequently add prices to the rate of new vehicles. There are also guidelines to regulate such things as using billboards and also signs along highways. Other guidelines regulate redeeming land after strip mining, disposing commercial waste right into streams as well as rivers, and also environmental pollution at flight terminals. The free business system is based on competition among businesses.

To ensure that a degree of competition exists, the Federal Government implements rigorous "antitrust" regulations to prevent anybody from acquiring syndicate control over a market. Some solutions, referred to as "all-natural syndicates," are much more successfully given when there is competitors - tax accounting. The best-known examples are the utility business, which supply water, gas, as well as electrical energy for house and business use.

Tax As Distinguished From License Fee for Beginners

The capitalism system presumes that customers are knowledgeable regarding the top quality or safety of what they get. In our contemporary culture, it is commonly difficult for consumers to make educated options. For public defense, federal government agencies at the Federal, State, as well as regional levels concern and apply regulations. There are guidelines to cover the high quality as well as security of such points as residence construction, vehicles, and electrical home appliances.

Another crucial kind of consumer security is the use of licenses to prevent unqualified individuals from functioning in certain areas, such as medicine or the building trades. City and county federal governments have the key responsibility for primary and additional education.

Federal grants used for carrying out research are an essential resource of cash for universities and also universities. Because the 1930s, the Federal Government has been supplying earnings or services, frequently called a "security internet," for those in requirement. Major programs include wellness services for the senior and also financial assistance for the handicapped and unemployed.

The Only Guide for Tax Accounting

Taxes in the USA Federal governments spend for these solutions via profits gotten by straining 3 financial bases: income, intake and also wealth. The Federal Federal government tax obligations revenue as its main source of revenue. State governments use tax obligations on income and also intake, while city governments count nearly totally on exhausting property and also riches.The majority of the Federal Federal government's revenue originates from earnings taxes. The personal revenue tax creates regarding five times as much revenue as the company earnings tax. Not all revenue tax taxed similarly. Taxpayers having stock in a firm as well as after that selling it at a gain or loss have to report it on a special timetable.

By contrast, the rate of interest they gain click for source on cash in a normal interest-bearing account obtains consisted of with incomes, incomes and also other "common" revenue. tax avoidance and tax evasion. There are likewise numerous kinds of tax-exempt and also tax-deferred cost savings prepares available that influence on people's taxes. Pay-roll taxes are an important source of revenue for the Federal Government.

The smart Trick of Tax That Nobody is Talking About

Some state federal governments likewise utilize pay-roll tax obligations to pay for the state's unemployment payment programs. Over the years, the quantity paid in social protection taxes has actually greatly boosted.Taxes on Intake The most important taxes on usage are sales and excise tax obligations. Sales tax obligations generally make money on such things as automobiles, apparel as well as flick tickets. Sales tax obligations are a vital source of income for many states as well as some huge cities and regions. The tax obligation rate differs from state to state, and the listing of taxable items or services also differs from one state to the following.

Instances of items based on Federal excise taxes are heavy tires, angling tools, aircraft tickets, gas, beer and also taxidermy alcohol, guns, and cigarettes. The objective of import tax taxes is to position the burden of paying the tax on the consumer. A fine example of this usage of import tax tax obligations is the gasoline excise tax obligation.

Taxonomy Fundamentals Explained

Only individuals that purchase gas-- who use the highways-- pay the tax. Some products get strained to discourage their usage. This relates to excise tax obligations on alcohol and tobacco. Excise taxes are additionally utilized throughout a battle or nationwide emergency situation. By increasing the cost of scarce products, the government can lower the need for these things.A lot of regions tax obligation exclusive homes, land, and also business residential or commercial property based on the residential or commercial property's value. Usually, the tax obligations obtain paid monthly along with the home loan repayment.

The Definitive Guide for Tax Avoidance

Taxpayers might subtract a particular quantity on their tax obligation returns for each allowable "exemption." By reducing one's gross income, these exceptions and deductions support the standard principle of straining according to capability to pay. Those with high gross incomes pay a bigger percent of their earnings in tax obligations. This portion is the "tax obligation price." Considering that those with higher taxed revenues pay a greater percent, the Government revenue tax is a "modern" tax.Report this wiki page